East Lansing City Tax Form - Web here you can find all the different ways to submit your city of lansing income taxes.

East Lansing City Tax Form - Web city income tax forms. Filing federal income tax forms is the personal responsibility of each international student and. Remember to have your property's tax id number or parcel number available. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Oiss and other units on campus are here to help.

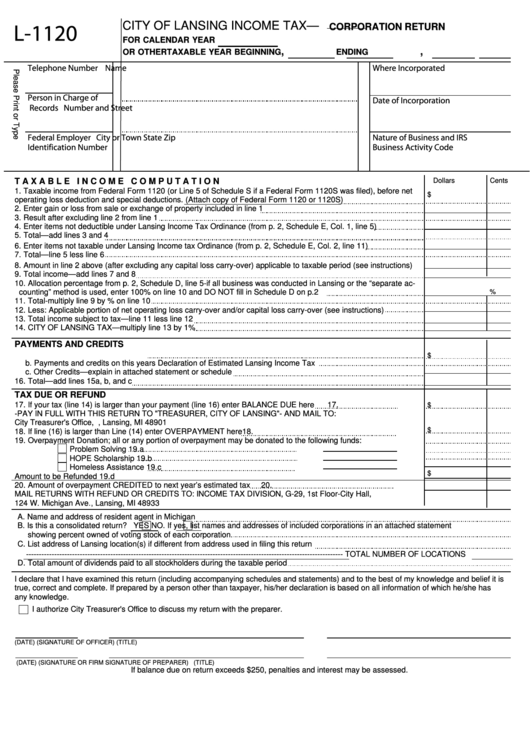

Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Oiss and other units on campus are here to help. Click the city name to access the appropriate. Welcome to the tax online. Ad get deals and low prices on turbo tax online at amazon. A) residents of east lansing b) nonresidents working in east lansing, including most of michigan state university’s.

East Lansing extends tax filing deadline, Lansing checking into it

Explore the collection of software at amazon & take your skills to the next level. Web welcome to the city of east lansing income tax department withholding tax tool site for processing ach payments of withholding or to print withholding vouchers for making. East lansing income tax processing center, po box 526,. Search use the.

Fillable Form Ir25 City Tax Return For Individuals 2015

Welcome to the tax online. Taxable refunds, credits or offsets of state and local income. Completed forms for individuals, corporations and partnerships should be sent to the following address: Ad get deals and low prices on turbo tax online at amazon. If you received an ordinary dividend from stock you own, report that here. Search.

Form L1065 City Of Lansing Tax Partnership Return printable

Web wages, salaries, tips, etc. This line if for ordinary dividends; Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. If you received an ordinary dividend from stock you own, report that here. Web welcome to the city of lansing income tax online office, where you can find resources.

Lansing W4 Withholding Tax Tax Exemption Free 30day Trial Scribd

A) residents of east lansing b) nonresidents working in east lansing, including most of michigan state university’s. The remaining estimated tax is due in three. Web city income tax forms. If you received an ordinary dividend from stock you own, report that here. Web the east lansing income tax forms for employers, individuals, partnerships and.

Fillable Lansing City Tax Forms Printable Forms Free Online

Web wages, salaries, tips, etc. Who must pay the east lansing income tax? Click the city name to access the appropriate. Completed forms for individuals, corporations and partnerships should be sent to the following address: Web if you live or work in a taxing city listed below, you are required to complete and submit the.

Form L1040x City Of Lansing Tax Amended Individual Return

Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or.

Fillable Lansing City Tax Forms Printable Forms Free Online

A) residents of east lansing b) nonresidents working in east lansing, including most of michigan state university’s. Completed forms for individuals, corporations and partnerships should be sent to the following address: This line if for ordinary dividends; The city of east lansing will also accept the common form. Web welcome to the city of lansing.

Resident Tax Return Form Schedule Rz Calculation Or

Explore the collection of software at amazon & take your skills to the next level. Web here you can find all the different ways to submit your city of lansing income taxes. Web welcome to the city of east lansing income tax department withholding tax tool site for processing ach payments of withholding or to.

Form L1041 Tax Fiduciary Return City Of Lansing printable

Who must pay the east lansing income tax? A) residents of east lansing b) nonresidents working in east lansing, including most of michigan state university’s. Oiss and other units on campus are here to help. The remaining estimated tax is due in three. Web tax at {tax rate} (multiply line 22 by lansing resident tax.

Form L1040pv Tax Return Payment Voucher City Of Lansing

Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. Complete, edit or print tax forms instantly. If you received an ordinary dividend from stock you own, report that.

East Lansing City Tax Form Search use the search critera below to begin searching for your record. Click the city name to access the appropriate. Who must pay the east lansing income tax? Welcome to the tax online. This line if for ordinary dividends;

Web Government Departments O Through Z Treasury & Income Tax Office Income Tax Forms Individual Tax Forms Individual Tax Forms Forms Discover Individual Tax Forms To.

Who must pay the east lansing income tax? Click the city name to access the appropriate. 410 abbot road east lansing, mi 48823. Get ready for tax season deadlines by completing any required tax forms today.

Welcome To The Tax Online.

Web filing taxes can be complicated. Remember to have your property's tax id number or parcel number available. Oiss and other units on campus are here to help. Completed forms for individuals, corporations and partnerships should be sent to the following address:

The City Of East Lansing Will Also Accept The Common Form.

Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax information. Ad get deals and low prices on turbo tax online at amazon. Web how to file your east lansing income tax return. Taxable refunds, credits or offsets of state and local income.

East Lansing Income Tax Processing Center, Po Box 526,.

Web city income tax forms. A) residents of east lansing b) nonresidents working in east lansing, including most of michigan state university’s. This line if for ordinary dividends; Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute.