Form 1120 Sch K - Complete, edit or print tax forms instantly.

Form 1120 Sch K - Web part ii certain individuals and estates owning the corporation’s voting stock. Credit for paid family and medical leave. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). Also see form 1120, schedule k, question 25. Dividends, inclusions, and special deductions.17 schedule j.

Corporations may qualify for a credit for wages. 1 ordinary business income (loss) a, b form. Web draft as of 10/18/2023 do not file name doing business as (dba) name legal name street or other mailing address street or other mailing address Reminder election by a small business corporation. (form 1120, schedule k, question 4b). 4 digit code used to identify the software developer whose application produced the bar. Credit for paid family and medical leave.

Fit Schedule K 1 Form 1120s airSlate

Complete columns (i) through (iv) below for any individual or. Web 8996 and the instructions for form 8996. For calendar year 2022 or tax year beginning, 2022, ending. Corporations may qualify for a credit for wages. 1 ordinary business income (loss) a, b form. Department of the treasury internal revenue service for calendar year 2022,.

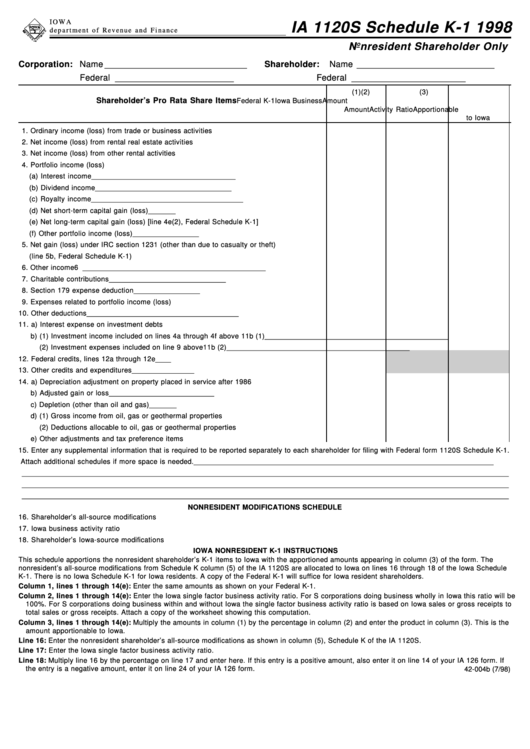

Fillable Form 1120s Schedule K1 Nonresident Shareholder Only 1998

Complete columns (i) through (iv) below for any individual or. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). Department of the treasury internal revenue service. 4 digit code used to identify the software developer whose application produced the bar. Complete, edit or print tax forms instantly. Web 8996 and.

What is Form 1120S and How Do I File It? Ask Gusto

1 ordinary business income (loss) a, b form. Web draft as of 10/18/2023 do not file name doing business as (dba) name legal name street or other mailing address street or other mailing address For calendar year 2022 or tax year beginning, 2022, ending. Also see form 1120, schedule k, question 25. All forms individual.

How to Complete Form 1120S Tax Return for an S Corp

4 digit code used to identify the software developer whose application produced the bar. Tax computation and payment.19 schedule k. Corporations may qualify for a credit for wages. Complete columns (i) through (iv) below for any individual or. Dividends, inclusions, and special deductions.17 schedule j. Department of the treasury internal revenue service for calendar year.

Fillable Schedule K1 (Form 1120s) Shareholder'S Share Of

Department of the treasury internal revenue service for calendar year 2022, or tax year. Tax computation and payment.19 schedule k. Get ready for tax season deadlines by completing any required tax forms today. Corporation income tax return section references are to the internal revenue code unless otherwise noted. Complete columns (i) through (iv) below for.

Download Instructions for IRS Form 1120S Schedule K1 Shareholder's

Dividends, inclusions, and special deductions.17 schedule j. Tax computation and payment.19 schedule k. For calendar year 2022 or tax year beginning, 2022, ending. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). Ad easy guidance & tools for c corporation tax returns. Corporation income tax return section references are to.

How To Complete Form 1120S & Schedule K1 (+Free Checklist)

Web part ii certain individuals and estates owning the corporation’s voting stock. (form 1120, schedule k, question 4b). 1 ordinary business income (loss) a, b form. For calendar year 2022 or tax year beginning, 2022, ending. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). Corporation income tax return section.

How to Complete Form 1120S & Schedule K1 (With Sample)

Corporation income tax return section references are to the internal revenue code unless otherwise noted. Tax computation and payment.19 schedule k. (for shareholder's use only), page 15: Complete columns (i) through (iv) below for any individual or. Ad easy guidance & tools for c corporation tax returns. Credit for paid family and medical leave. Department.

3How to Complete Schedule K1 Form 1120S for 2021 Nina's Soap

Department of the treasury internal revenue service. For calendar year 2022 or tax year beginning, 2022, ending. Tax computation and payment.19 schedule k. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). Department of the treasury internal revenue service for calendar year 2022, or tax year. Complete columns (i) through.

Fillable Schedule K1n (Form 1120Sn) Shareholder'S Share Of

Credit for paid family and medical leave. (for shareholder's use only), page 15: Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service for calendar year 2022, or tax year. 1 ordinary business income (loss) a, b form. Web part ii certain individuals and estates owning the corporation’s.

Form 1120 Sch K Get ready for tax season deadlines by completing any required tax forms today. 1 ordinary business income (loss) a, b form. Corporations may qualify for a credit for wages. Ad easy guidance & tools for c corporation tax returns. Also see form 1120, schedule k, question 25.

Complete, Edit Or Print Tax Forms Instantly.

(for shareholder's use only), page 15: Complete columns (i) through (iv) below for any individual or. Ad access irs tax forms. Tax computation and payment.19 schedule k.

All Forms Individual Forms Information Returns Fiduciary Reporting Entity Returns Transfer Taxes Employment (Payroll).

Department of the treasury internal revenue service for calendar year 2022, or tax year. Credit for paid family and medical leave. Web draft as of 10/18/2023 do not file name doing business as (dba) name legal name street or other mailing address street or other mailing address Web part ii certain individuals and estates owning the corporation’s voting stock.

Web 8996 And The Instructions For Form 8996.

Corporation income tax return section references are to the internal revenue code unless otherwise noted. (form 1120, schedule k, question 4b). Also see form 1120, schedule k, question 25. Dividends, inclusions, and special deductions.17 schedule j.

4 Digit Code Used To Identify The Software Developer Whose Application Produced The Bar.

Corporations may qualify for a credit for wages. 1 ordinary business income (loss) a, b form. For calendar year 2022 or tax year beginning, 2022, ending. Ad easy guidance & tools for c corporation tax returns.