Form 940 Annual - Ad edit, fill, sign 940 2017 federal & more fillable forms.

Form 940 Annual - Web form 940 is used to report the employer’s annual federal unemployment tax (futa). Top beginning with the 2006 tax year, the redesigned form 940 replaces previous. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. Web employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Employer's annual federal unemployment (futa) return :

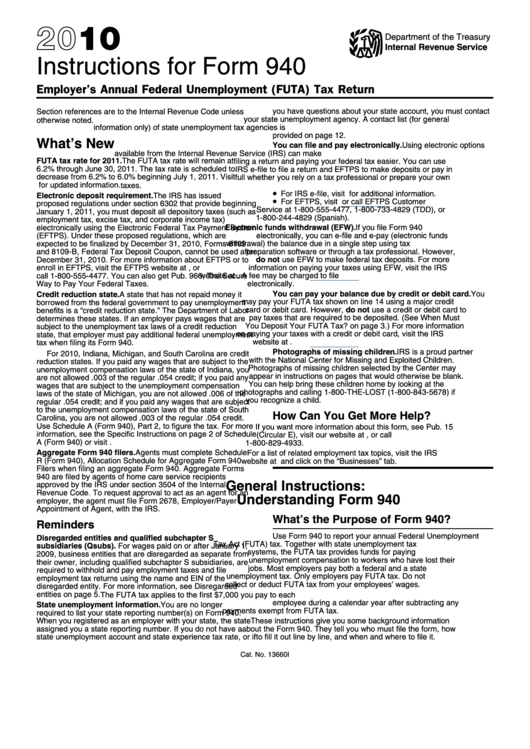

Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. Employers must report and pay unemployment taxes to the irs for their employees. Form 941 is required four times per year, while 940 is. Web definition irs form 940 is the federal unemployment tax annual report. This return is for a single state filer, and uses the most current copies of form 940 and. Web about form 940, employer's annual federal unemployment (futa) tax return. Form 940, employer's annual federal unemployment tax return.

Instructions For Form 940Ez Employer'S Annual Federal Unemployment

This return is for a single state filer, and uses the most current copies of form 940 and. Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to. Web the draft of form 940 schedule a indicates that california, connecticut, illinois,.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

The futa tax return differs from other employment. Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to. Ad get ready for tax season deadlines by completing any required tax forms today. Web definition irs form 940 is the federal unemployment.

SSA POMS RM 01103.044 Form 940, Employer's Annual Federal

Irs form 940 is due on january 31 of the year after the year of the report information. Web it’s about time to complete form 940, employer’s annual federal unemployment (futa) tax return. Employer's annual federal unemployment (futa) return : Web filing form 940 with the irs. Top beginning with the 2006 tax year, the.

Form 940 Instructions 2019 Fill Out and Sign Printable PDF Template

Web about form 940, employer's annual federal unemployment (futa) tax return. For example, the 940 for 2020 is due. Web employment tax forms: Use form 940 to report your annual federal unemployment tax act (futa) tax. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date.

form 940 2019 2020 Fill Online, Printable, Fillable Blank form

31 each year for the previous year. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web it’s about time to complete form 940, employer’s annual federal unemployment (futa) tax return. Complete, edit or print tax forms instantly. Web about form 940, employer's annual.

SSA POMS RM 01103.044 Form 940, Employer's Annual Federal

Web • form 940 • form 940 schedule r. Complete, edit or print tax forms instantly. Web definition irs form 940 is the federal unemployment tax annual report. Web the irs requires form 940 from business owners annually. Web employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Employer's annual federal unemployment (futa) return : The futa helps provide unemployment compensation to workers who have. It’s based on the federal. Top beginning with the 2006 tax year, the redesigned form 940 replaces previous. Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Ad edit, fill, sign 940 2017 federal & more fillable forms. Web employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web filing form 940 with the irs. Form 941 is required four times per year, while 940 is. Irs form 940 is due on january.

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

Form 941 is required four times per year, while 940 is. Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and the virgin islands will still be in credit reduction status for tax year. The futa tax return differs from other employment. Web definition irs form 940 is the.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Top beginning with the 2006 tax year, the redesigned form 940 replaces previous. Web form 940 is due on jan. For example, the 940 for 2020 is due. This document calculates the federal tax that supports individuals who qualify for unemployment. Web form 941 is the employer’s quarterly federal tax return, while form 940 is.

Form 940 Annual Web up to $32 cash back form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. Ad edit, fill, sign 940 2017 federal & more fillable forms. There may be earlier payment deadlines,. The futa helps provide unemployment compensation to workers who have. Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to.

Web 2022 Instructions For Form 940 Employer's Annual Federal Unemployment (Futa) Tax Return Department Of The Treasury Internal Revenue Service Section References Are To.

Web form 940 is due on jan. Web • form 940 • form 940 schedule r. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. It’s based on the federal.

Web Form 940 Is Used To Report The Employer’s Annual Federal Unemployment Tax (Futa).

Complete, edit or print tax forms instantly. This return is for a single state filer, and uses the most current copies of form 940 and. Ad edit, fill, sign 940 2017 federal & more fillable forms. The futa tax return differs from other employment.

Form 941 Is Required Four Times Per Year, While 940 Is.

Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and the virgin islands will still be in credit reduction status for tax year. There may be earlier payment deadlines,. Web employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web form 941 is the employer’s quarterly federal tax return, while form 940 is the annual employer tax report.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web filing form 940 with the irs. The futa helps provide unemployment compensation to workers who have. Irs form 940 is due on january 31 of the year after the year of the report information. For example, the 940 for 2020 is due.