Kansas Form K40 - Web enter your kansas standard deduction from the applicable chart or worksheet that follows.

Kansas Form K40 - Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: We last updated the individual. 1) your kansas income tax balance due, after. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Please allow 2 weeks for delivery.

Web kansas tax form, send your request through email at. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Enter the total number of exemptions in the total kansas exemptions box. Complete, edit or print tax forms instantly. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web enter your kansas standard deduction from the applicable chart or worksheet that follows. Estimated tax payments are required if:

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Amended returns must be filed within three years of when the original return was filed. Web kansas tax form, send your request through email at. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank.

Form K40 Kansas Individual Tax 2005 printable pdf download

1) your kansas income tax balance due, after. Web enter your kansas standard deduction from the applicable chart or worksheet that follows. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Total income derived from other state and included in kagi: Enter the.

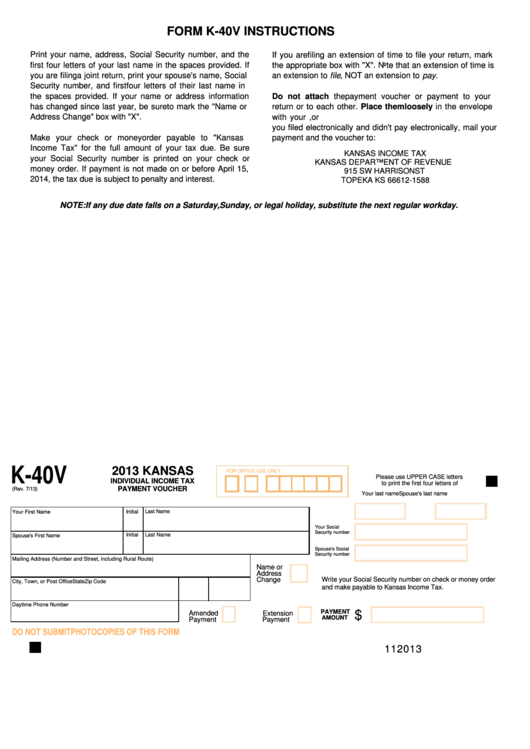

Fillable Form K40v Kansas Individual Tax Payment Voucher

Web kansas tax form, send your request through email at. Total income derived from other state and included in kagi: Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. Web webfile is an online application.

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Web enter your kansas standard deduction from the applicable chart or worksheet that follows. Complete, edit or print tax forms instantly. Please allow 2 weeks for delivery. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Web you must make estimated tax payments if your estimated kansas income tax.

KS DoR K40 2014 Fill out Tax Template Online US Legal Forms

We last updated the individual. Enter the total number of exemptions in the total kansas exemptions box. Web fill online, printable, fillable, blank form 2021: Web enter your kansas standard deduction from the applicable chart or worksheet that follows. Web kansas tax form, send your request through email at. Web webfile is an online application.

Fillable Form K40es Kansas Individual Estimated Tax Voucher

We last updated the individual. 1) you are required to file a federal income tax return; Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Estimated tax payments are required if: This form is for income earned in tax year 2022, with tax.

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

Estimated tax payments are required if: Web enter your kansas standard deduction from the applicable chart or worksheet that follows. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web kansas tax form,.

Kansas k40 form Fill out & sign online DocHub

Amended returns must be filed within three years of when the original return was filed. Enter the total number of exemptions in the total kansas exemptions box. We last updated the individual. 1) you are required to file a federal income tax return; This form is for income earned in tax year 2022, with tax.

Fillable Form K40es Individual Estimated Tax Kansas Department Of

Total income derived from other state and included in kagi: Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. Web fill online, printable, fillable, blank form 2021: Complete, edit or print tax forms instantly. We.

Fillable Form K40h Kansas Homestead Claim 2001 printable pdf download

Enter the total number of exemptions in the total kansas exemptions box. This form is for income earned in tax year 2022, with tax returns due in april. Total income derived from other state and included in kagi: 1) your kansas income tax balance due, after. Web webfile is an online application for filing kansas.

Kansas Form K40 This form is for income earned in tax year 2022, with tax returns due in april. Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. Estimated tax payments are required if: Total income derived from other state and included in kagi: Please allow 2 weeks for delivery.

Please Allow 2 Weeks For Delivery.

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web enter your kansas standard deduction from the applicable chart or worksheet that follows. Amended returns must be filed within three years of when the original return was filed. Complete, edit or print tax forms instantly.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

1) you are required to file a federal income tax return; 1) your kansas income tax balance due, after. Estimated tax payments are required if: Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if:

Web You Must Make Estimated Tax Payments If Your Estimated Kansas Income Tax After Withholding And Credits Is $500 Or More And Your Withholding And Credits May Be Less.

Enter the total number of exemptions in the total kansas exemptions box. Total income derived from other state and included in kagi: Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. We last updated the individual.

Web Kansas Tax Form, Send Your Request Through Email At.

Web fill online, printable, fillable, blank form 2021: