Kansas K4 Form - A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

Kansas K4 Form - Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web this form enables an employee to estimate the percentage of services performed in kansas. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. However, due to differences between state and. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form must be filed with the employee’s employer. This form is for income earned in tax year 2022, with tax returns due in april. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. However, due to differences between state and. This form must be filed with the employee’s employer. However, due to differences between state and. Whether you are entitled to claim a certain number of.

Kansas K4 Form For State Withholding

This form must be filed with the employee’s employer. Web this form enables an employee to estimate the percentage of services performed in kansas. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. It must be printed and. A completed withholding allowance.

Fill Free fillable Form 500518 K4 KANSAS EMPLOYEES WITHHOLDING

This form must be filed with the employee’s employer. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form.

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how.

Kansas K 4 Form 2023 Printable Forms Free Online

This form must be filed with the employee’s employer. Whether you are entitled to claim a certain number of allowances or exemptions from withholding is subject to review. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let.

K 4 KANSAS

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form must be filed with the employee’s employer. A completed withholding allowance.

Form K40h Kansas Homestead Claim 2008 printable pdf download

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. However, due to differences between state.

State Tax Withholding Forms Template Free Download Speedy Template

However, due to differences between state and. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web up to $40 cash back the kansas.

k4 form.pdf Withholding Tax Stepfamily

Download or email ks p1032 & more fillable forms, register and subscribe now! Web this form enables an employee to estimate the percentage of services performed in kansas. This form must be filed with the employee’s employer. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld.

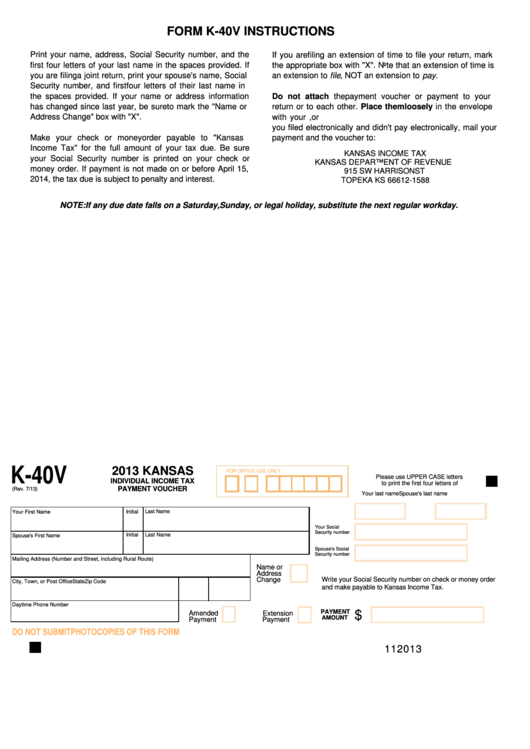

Fillable Form K40v Kansas Individual Tax Payment Voucher

Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. However, due to differences between state.

Kansas K4 Form It must be printed and. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. However, due to differences between state and. This form is for income earned in tax year 2022, with tax returns due in april. However, due to differences between state and.

Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On.

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. However, due to differences between state and. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Whether you are entitled to claim a certain number of allowances or exemptions from withholding is subject to review.

Web Up To $40 Cash Back The Kansas K4 Form Is Used For Various Purposes, But Most Commonly It Is Used For Updating The Address Of A Registered Vehicle In The State Of Kansas.

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form must be filed with the employee’s employer. However, due to differences between state and. Web this form enables an employee to estimate the percentage of services performed in kansas.

A Completed Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On.

This form is for income earned in tax year 2022, with tax returns due in april. Download or email ks p1032 & more fillable forms, register and subscribe now! A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year.