Montana Property Tax Rebate Form - Please join us for property assessment division.

Montana Property Tax Rebate Form - The fastest way for taxpayers to apply for and get the rebate is by applying online. We will be updating this page as new information becomes available. Dor communicates rebate information at. For those whose filing status was single, head of household, or married filing separately, the rebate will be either $1,250 or the line 20 amount, whichever is less. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form during an application period that runs from aug.

Claims must be filed by october 1, 2023. 2022 claims must be filed by october 1, 2023. Web these bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222). The qualifications to claim the rebate are at getmyrebate.mt.gov. Montana's property tax rebate is a rebate of up to $675 a year of property taxes paid on a principal residence. Web property tax exemption application. The department accepted online claims until 11:59pm on october 2, 2023 and will accept paper claims postmarked by october 2, 2023.

Form MDV Download Fillable PDF or Fill Online Montana Disabled Veteran

Web fri, march 24th 2023, 5:40 am pdt (photo: How do i claim a property tax rebate? Web homeowners have until oct. Web these bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222). This rebate is only available.

Form INH4 Download Printable PDF or Fill Online Application for

Web 3 paid property taxes on this residence. There are rebates available for property taxes paid for both the 2022 and 2023 tax years. How do i claim a property tax rebate? Web 3 paid property taxes on this residence. Homeowners are eligible if they owned and. Dor communicates rebate information at. Montana's property tax.

Montana State Property Tax Rebate

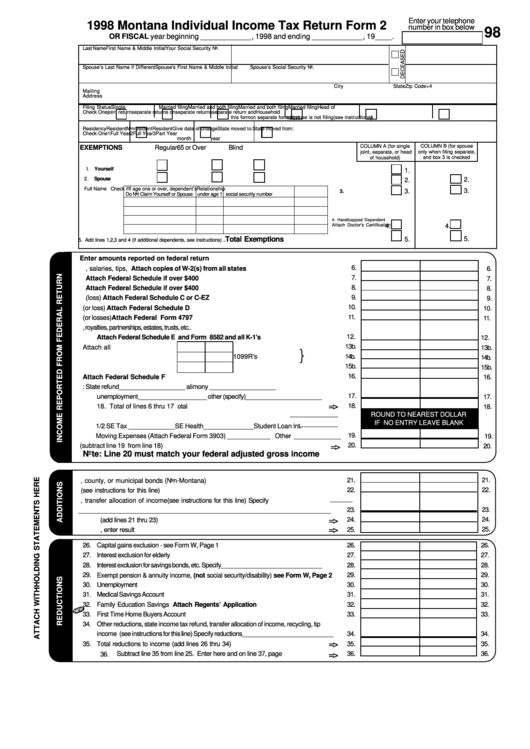

Learn about the individual income tax rebate. Web the individual income tax rebate amount depends on a taxpayer’s 2021 filing status and the amount of tax paid for 2021, which can be found on line 20 of the 2021 montana form 2. Visit the department’s webpage devoted to the rebates to learn more and see.

Fillable FormFid Montana Estate Or Trust Tax Payment Voucher

We will be updating this page as new information becomes available. The department accepted online claims until 11:59pm on october 2, 2023 and will accept paper claims postmarked by october 2, 2023. Montana's property tax rebate is a rebate of up to $675 a year of property taxes paid on a principal residence. Greg gianforte.

Fillable Form 2 Montana Individual Tax Return 1998 printable

How do i claim a property tax rebate? We will be updating this page as new information becomes available. Web 3 paid property taxes on this residence. There are rebates available for property taxes paid for both the 2022 and 2023 tax years. How do i claim a property tax rebate? Web the montana property.

lasopacleveland Blog

Web 3 paid property taxes on this residence. The last day to claim the montana property tax rebate is monday, october 2. According to the department, claims made electronically through its website must be filed by 11:59. Web montana property tax rebate. We will be updating this page as new information becomes available. Web what.

Fillable Homeowner Property Tax Refund Form Montana Department Of

(a) $500 or the amount of total property taxes paid, whichever is less, for tax year 2022; Download the montana property tax exemption application. Claims must be filed by october 1, 2023. Web the montana property tax rebate provides qualifying montanans up to $675 of property tax relief on a primary residence in both 2023.

Montana Personal Property Tax PROPERTY BSI

Claims must be filed by october 1, 2023. There are rebates available for property taxes paid for both the 2022 and 2023 tax years. Web montana homeowners have through this coming monday, oct. Dor communicates rebate information at. Beginning august 15, 2023, taxpayers may claim their 2022 rebate online at getmyrebate.mt.gov or by paper form..

Property Tax Rebate Application printable pdf download

A second application period for 2023 rebates will be open across the same dates in 2024. Web these bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222). The last day to claim the montana property tax rebate is.

Form Fid Montana Estate Or Trust Tax Payment printable pdf download

Web montana homeowners have through this coming monday, oct. House bill 192 — use surplus revenue for income tax and property tax refunds and payment of bonds. Web governor's office august 14 2023 helena, mont. You will be required to submit a new. Web the amount of montana property taxes billed and paid on the.

Montana Property Tax Rebate Form Web check the status of your property tax rebate. These you have to apply for. Web the montana property tax rebate provides qualifying montanans up to $675 of property tax relief on a primary residence in both 2023 and 2024. Web the department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form during an application period that runs from aug. Web the property tax rebate claim period has closed.

Web Beginning August 15, Eligible Montana Homeowners May Claim Their Property Tax Rebate Up To $675 At Getmyrebate.mt.gov.

Web the last date to apply for the montana property tax rebate is october 1. Web 3 paid property taxes on this residence. Web the montana property tax rebate provides qualifying montanans up to $675 of property tax relief on a primary residence in both 2023 and 2024. According to the department, claims made electronically through its website must be filed by 11:59.

Web The Montana Property Tax Rebate Provides Qualifying Montanans Up To $675 Of Property Tax Relief On A Primary Residence In Both 2023 And 2024.

Claims must be filed by october 1, 2023. Web the property tax rebate claim period has closed. Web 3 paid property taxes on this residence. Eligible homeowners can claim up to $675 in montana property tax rebate.

Web Montana Property Tax Rebate.

(a) $500 or the amount of total property taxes paid, whichever is less, for tax year 2022; The fastest way for taxpayers to apply for and get the rebate is by applying online. The qualifications to claim the rebate are at getmyrebate.mt.gov. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form during an application period that runs from aug.

2 — A Figure That, Mtfp Calculates, Represents About.

Web montana homeowners have through this coming monday, oct. Please join us for property assessment division. Web the property tax rebate can be applied for either through the online portal set up by the state or by paper form. (1) subject to the conditions provided for in [sections 1 through 3], there is a rebate of montana property taxes in the amount of: