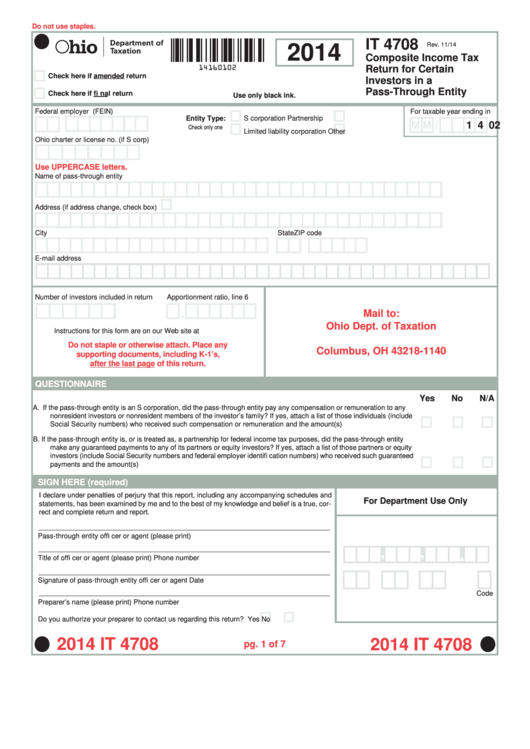

Ohio Form It 4708 - A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors.

Ohio Form It 4708 - Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. The pte can elect to file. Ad register and subscribe now to work on your oh form it re & more fillable forms. Filing the it 4738 makes the election.

Web it 4708 upc is an ohio corporate income tax form. For taxable year ending in. A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. Web should the pte file the it 4708? Election is made each year by filing the it 4738. Open the ohio business return. Open the federal 1065 or federal 1120s.

Form It4708 Annual Composite Tax Return For Investors In Pass

Web • the pte is filing an amended it 4708 and the original filed it 4708 reported an overpayment/refund on line 20 of the original it 4708. Web form / instructions. Web form is available in the tax forms section of tax.ohio.gov. 2) whether to file form ohio it. Election is made each year by.

Form It 4708 Composite Tax Return For Certain Investors In A

1) when the new reduced tax rate of 4.797 percent applies; Web should the pte file the it 4708? Election is made each year by filing the it 4738. The due date of the return (april 18 for 2022) it is. Web the instructions are updated for tax year 2019 to include information on: Open.

Form It 4708es Ohio Estimated Tax Payment Coupon For Investors

1) when the new reduced tax rate of 4.797 percent applies; Open the federal 1065 or federal 1120s. Do not write in this area; Web the instructions are updated for tax year 2019 to include information on: The due date for filing the it 4738 is. A pte may be subject to the interest penalty.

Fillable Form It4708 Annual Composite Tax Return For

Web form / instructions. A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. Web the it 4738 will have a line to transfer estimated payments made on the it 1140 or it 4708 forms. Get ready for tax season deadlines by completing.

How Do I Calculate Tax Coloring Pages Motherhood

The due date of the return (april 18 for 2022) it is. 2) whether to file form ohio it. From the input return tab, go to state & local ⮕ other forms ⮕ oh passthrough / composite rtrn. Filing the it 4738 makes the election. Web we last updated ohio form it 4708 in february.

Ohio Form It 4708 ≡ Fill Out Printable PDF Forms Online

Open the ohio business return. Get ready for tax season deadlines by completing any required tax forms today. 1) when the new reduced tax rate of 4.797 percent applies; Web form is available in the tax forms section of tax.ohio.gov. Open the federal 1065 or federal 1120s. Ohio withholding overpayments can also be applied to.

Ohio Form Ft 1120s, It 4708 And It 1140 Abbreviated Instructions Pass

For taxable year ending in. Web it 4708 upc is an ohio corporate income tax form. Election is made each year by filing the it 4738. Web form / instructions. Ohio withholding overpayments can also be applied to the new. Web • the pte is filing an amended it 4708 and the original filed it.

Ohio Affidavit Form Fill Out And Sign Printable Pdf Template 1DF

Election is made each year by filing the it 4738. Web should the pte file the it 4708? Go to the ohio > passthrough entity tax return (it 1140) > composite return worksheet. Open the federal 1065 or federal 1120s. A pte must file an ohio return to report and pay tax on behalf of.

Ohio It3 Form Fill Out and Sign Printable PDF Template signNow

From the input return tab, go to state & local ⮕ other forms ⮕ oh passthrough / composite rtrn. 5747.08(g), the it 4708 is due on. The due date of the return (april 18 for 2022) it is. Get ready for tax season deadlines by completing any required tax forms today. Web should the pte.

20202023 Form OH IT 4708 UPC Fill Online, Printable, Fillable, Blank

A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. 5747.08(g), the it 4708 is due on. For taxable year ending.

Ohio Form It 4708 Web should the pte file the it 4708? The pte can elect to file. A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. Web the instructions are updated for tax year 2019 to include information on: Web form is available in the tax forms section of tax.ohio.gov.

From The Input Return Tab, Go To State & Local ⮕ Other Forms ⮕ Oh Passthrough / Composite Rtrn.

A pte may be subject to the interest penalty even if it is due a refund when filing its return. Ad register and subscribe now to work on your oh form it re & more fillable forms. Open the ohio business return. The pte can elect to file.

A Pte Must File An Ohio Return To Report And Pay Tax On Behalf Of Its Nonresident Individual, Trust, And Pte Investors.

Do not write in this area; Go to the ohio > passthrough entity tax return (it 1140) > composite return worksheet. The due date of the return (april 18 for 2022) it is. Web should the pte file the it 4708?

2) Whether To File Form Ohio It.

5747.08(g), the it 4708 is due on. Web the instructions are updated for tax year 2019 to include information on: Ohio withholding overpayments can also be applied to the new. Web form is available in the tax forms section of tax.ohio.gov.

Web The It 4738 Will Have A Line To Transfer Estimated Payments Made On The It 1140 Or It 4708 Forms.

Calendar year and fiscal year filers pursuant to r.c. Web it 4708 upc is an ohio corporate income tax form. Web should the pte file the it 4708? A pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors.