Schedule B Form 941 - If you're a semiweekly schedule depositor and you don’t properly.

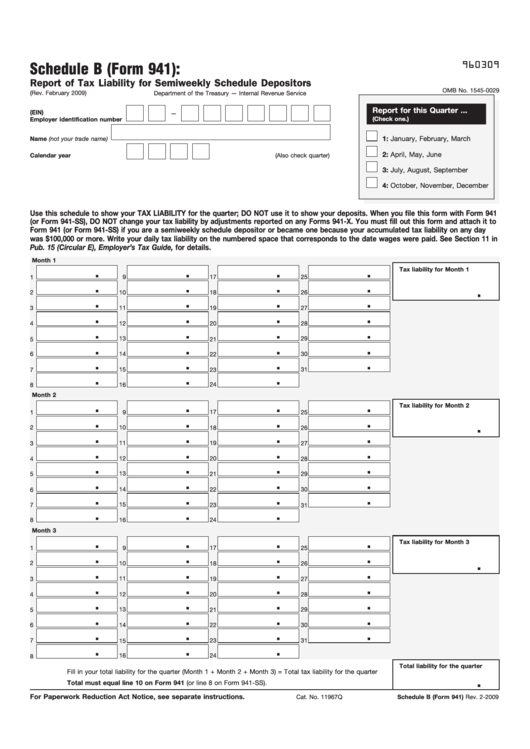

Schedule B Form 941 - Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. 15 or section 8 of pub. This form must be completed by a semiweekly schedule depositor who. Web if you are a monthly schedule depositor, complete the deposit schedule below; Web purpose of schedule b (form 941) these instructions tell you about schedule b (form 941), report of tax liability for semiweekly schedule depositors.

Web purpose of schedule b (form 941) these instructions tell you about schedule b (form 941), report of tax liability for semiweekly schedule depositors. You must complete all three. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web file schedule b (form 941) if you are a semiweekly schedule depositor. You received interest from a seller. Don't use an earlier revision to report taxes for 2023. Complete, edit or print tax forms instantly.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

For tax years beginning before january 1, 2023, a qualified small business may elect to. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. You are a semiweekly depositor if you: Web purpose of schedule b (form 941) these instructions.

Form 941 Employer'S Quarterly Federal Tax Return 2009 printable pdf

Web if you are a monthly schedule depositor, complete the deposit schedule below; Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Use schedule b (form 1040) if any of the following applies. You received interest from a seller. 15 or section 8 of pub. This.

Standard Report 941 Schedule B Template Avionte Classic

Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that. If you are a semiweekly schedule depositor, attach schedule b (form 941). 15 or section 8 of pub. If you're a semiweekly schedule depositor and you don’t properly. Web schedule b.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Calculate the total federal income tax withheld from employees’ paychecks. 15 or section 8 of pub. Complete, edit or print tax forms instantly. This form must be completed by a semiweekly schedule depositor who. Reported more than $50,000 of employment taxes in the. If you're a semiweekly schedule depositor and you don’t properly. You must.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Calculate the total federal income tax withheld from employees’ paychecks. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest.

IRS Form 941 Sched B

Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. If you are a semiweekly schedule depositor, attach schedule b (form 941). 15 or section 8 of pub. You are a semiweekly depositor if you: Don't use an earlier revision to report taxes for 2023. Web you are required to file.

Form 941 Schedule B Edit, Fill, Sign Online Handypdf

Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Web complete schedule b (form 941),.

Printable Schedule B Form 941 Fillable Form 2023

This form must be completed by a semiweekly schedule depositor who. You had over $1,500 of taxable interest or ordinary dividends. For tax years beginning before january 1, 2023, a qualified small business may elect to. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such.

941 Form 2020 Printable Printable World Holiday

See deposit penalties in section 11 of pub. Don't use an earlier revision to report taxes for 2023. Use schedule b (form 1040) if any of the following applies. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. You received interest from a seller. At this time, the irs expects.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

At this time, the irs expects the march. This form must be completed by a semiweekly schedule depositor who. Web if you are a monthly schedule depositor, complete the deposit schedule below; Reported more than $50,000 of employment taxes in the. 15 or section 8 of pub. Web the irs uses schedule b to determine.

Schedule B Form 941 If you are a semiweekly schedule depositor, attach schedule b (form 941). Calculate the total federal income tax withheld from employees’ paychecks. Use schedule b (form 1040) if any of the following applies. You are a semiweekly depositor if you: 15 or section 8 of pub.

This Form Must Be Completed By A Semiweekly Schedule Depositor Who.

Don't use an earlier revision to report taxes for 2023. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; If you're a semiweekly schedule depositor and you don’t properly. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Use Schedule B (Form 1040) If Any Of The Following Applies.

See deposit penalties in section 11 of pub. If you are a semiweekly schedule depositor, attach schedule b (form 941). For tax years beginning before january 1, 2023, a qualified small business may elect to. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Web The Irs Uses Schedule B To Determine If You’ve Deposited Your Federal Employment Tax Liabilities On Time.

You are a semiweekly depositor if you: You must complete all three. Ad get ready for tax season deadlines by completing any required tax forms today. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that.

15 Or Section 8 Of Pub.

Sum up all wages, tips, and other payments made to employees. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. You had over $1,500 of taxable interest or ordinary dividends. Complete, edit or print tax forms instantly.