T1 Tax Form - Foreign income must also be declared and included in the total income.

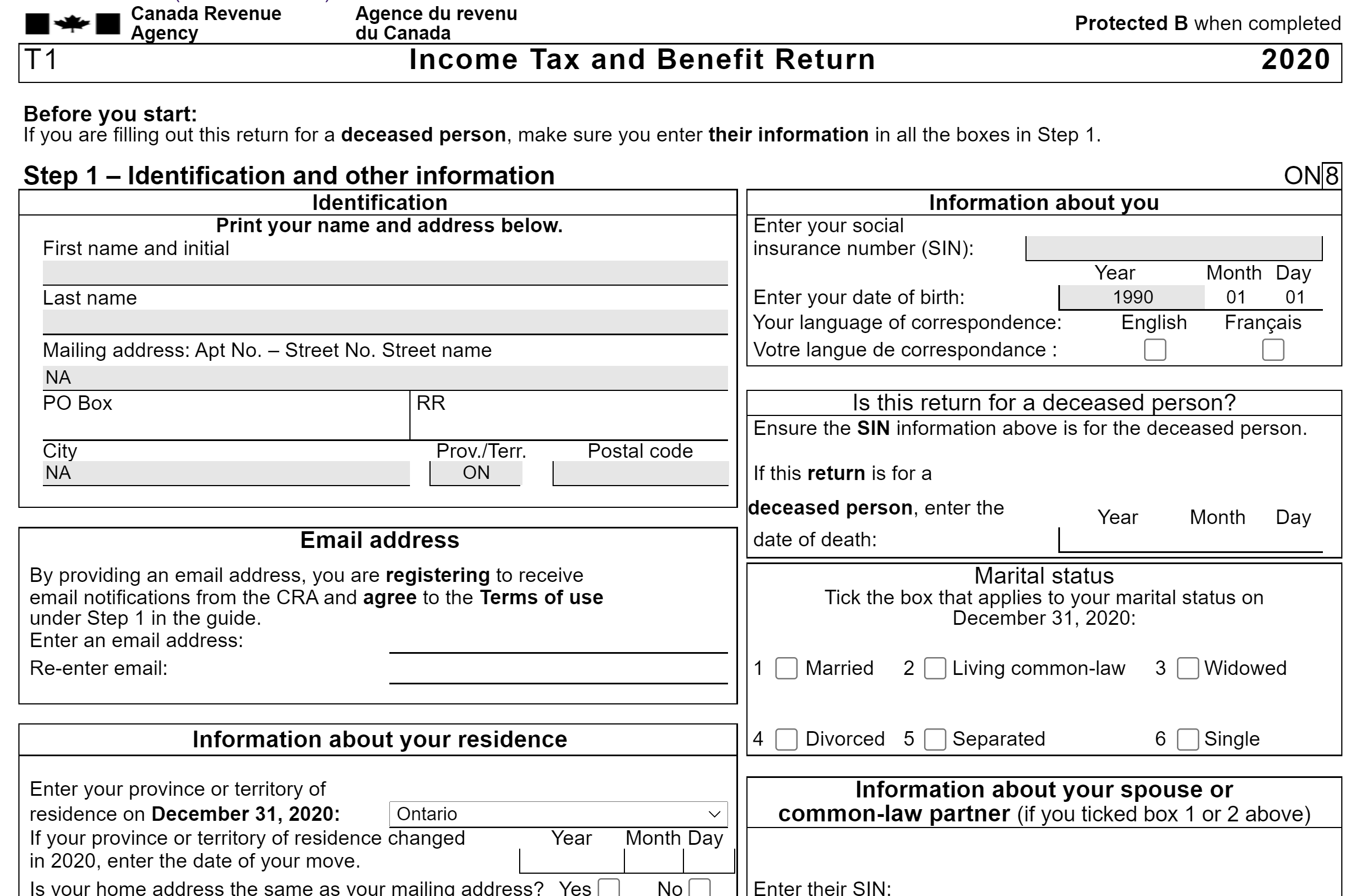

T1 Tax Form - Web it summarizes the taxpayer's income, deductions and tax payable as computed on supporting forms and schedules and calculates the taxpayer's refund or balance due. Web canada.ca canada revenue agency forms and publications forms, guides, tax packages, and other canada revenue agency (cra) publications. Here is what you need to know about your t1 general return, including who. The t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return. Find articles, video tutorials, and more.

The t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return. Web get help with quickbooks. Web a t1 tax return, also known as the general income tax and benefit return, is the primary form that canadian individuals use to file their annual income tax return. Web what is the t1 tax form? It is the document used by canadians to file their personal taxes (as. It captures everything from total income to net income to taxable income and lets you. Here is what you need to know about your t1 general return, including who.

T1 General Sample

Web what is the t1 tax form? It captures everything from total income to net income to taxable income and lets you. This form is a summary of all income taxes paid to the canada revenue agency. Foreign income must also be declared and included in the total income. Additional information and forms available at.

Form t661 Fill out & sign online DocHub

After applicable deductions and adjustm… Web it summarizes the taxpayer's income, deductions and tax payable as computed on supporting forms and schedules and calculates the taxpayer's refund or balance due. Additional information and forms available at www.azdor.gov • required information is designated with an asterisk. Foreign income must also be declared and included in the.

Form T1136 2019 Fill Out, Sign Online and Download Fillable PDF

Web canada.ca canada revenue agency forms and publications forms, guides, tax packages, and other canada revenue agency (cra) publications. The waste tire fee is required to be collected by sellers of new motor vehicle tires in arizona. This form is a summary of all income taxes paid to the canada revenue agency. Web • please.

T1 General Mackenzie Gartside & Associates

Web the t1 taxpayer's form is also known as the income tax and benefit return. Web • please read form instructions while completing the application. It captures everything from total income to net income to taxable income and lets you. It is the document used by canadians to file their personal taxes (as. Here is.

What is a Notice of Assessment (NOA) and T1 General? Filing Taxes

Web the t1 taxpayer's form is also known as the income tax and benefit return. Web • please read form instructions while completing the application. Provide the amount of gross income you can reasonably expect to generate in your first twelve months of business. After applicable deductions and adjustm… All working canadians need to fill.

T1 General Form Explained for Canadians PiggyBank

It captures everything from total income to net income to taxable income and lets you. Find articles, video tutorials, and more. Provide the amount of gross income you can reasonably expect to generate in your first twelve months of business. You will be set up for monthly filing unless your. Additional information and forms available.

Form T1 General Tax And Benefit Return 2015 printable pdf

Web the t1 general form is the primary document used to file personal income taxes in canada. The waste tire fee is required to be collected by sellers of new motor vehicle tires in arizona. For information or help, call one of the numbers listed: Here is an overview of everything canadians need to know.

Tux 2007 — An Tax Spreadsheet in ODF

Web it summarizes the taxpayer's income, deductions and tax payable as computed on supporting forms and schedules and calculates the taxpayer's refund or balance due. Find articles, video tutorials, and more. All working canadians need to fill out and file this form. You will be set up for monthly filing unless your. The t1 general.

2009 t1 form Fill out & sign online DocHub

Find articles, video tutorials, and more. Web 2018 nonrefundable individual arizona form tax credits and recapture 301. For example, tax preparers will simply call a personal tax return a “t1.” likewise, a corporate tax return is a “t2,” and a trust return, a “t3.” in this section, we will explore. Foreign income must also be.

What is a T1 General Tax Form? Canada Buzz

Web • please read form instructions while completing the application. Find articles, video tutorials, and more. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web the t1 general form is the primary document used to file personal income taxes in canada. Web.

T1 Tax Form It is the document used by canadians to file their personal taxes (as. Web vita client instructions and forms. Additional information and forms available at www.azdor.gov • required information is designated with an asterisk. Provide the amount of gross income you can reasonably expect to generate in your first twelve months of business. Here is what you need to know about your t1 general return, including who.

Web 2018 Nonrefundable Individual Arizona Form Tax Credits And Recapture 301.

You will be set up for monthly filing unless your. The waste tire fee is required to be collected by sellers of new motor vehicle tires in arizona. Web the t1 general form is also called the entitled income tax and benefit return form. All working canadians need to fill out and file this form.

After Applicable Deductions And Adjustm…

For information or help, call one of the numbers listed: Additional information and forms available at www.azdor.gov • required information is designated with an asterisk. The t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return. Here is an overview of everything canadians need to know about the t1 form,.

Here Is An Overview Of Everything Canadians Need To Know About The T1 Form, Including Who.

Foreign income must also be declared and included in the total income. Web the t1 general form is the primary document used to file personal income taxes in canada. Web individual income tax forms. Provide the amount of gross income you can reasonably expect to generate in your first twelve months of business.

Web Get Help With Quickbooks.

The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Check if an application to determine eligibility of a trustee pursuant to section 305(b)(2) (exact name of trustee as specified in its charter). For example, tax preparers will simply call a personal tax return a “t1.” likewise, a corporate tax return is a “t2,” and a trust return, a “t3.” in this section, we will explore. Web it summarizes the taxpayer's income, deductions and tax payable as computed on supporting forms and schedules and calculates the taxpayer's refund or balance due.