Form Ct 1096 - You need not submit original and corrected returns separately.

Form Ct 1096 - Your name and taxpayer identification number. If the due date falls on a saturday, sunday,. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. See electronic filing requirement, below. It should not be submitted to the state even if you have.

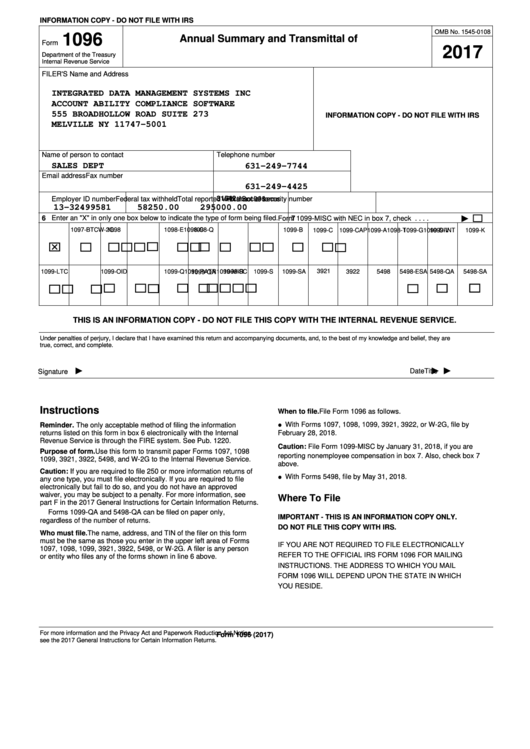

11/19) department of revenue services state of connecticut po box 2930 hartford ct. Web any person or entity who files any form checked in box 6 above must file form 1096 to transmit those forms to the irs. 01/09) complete for each period connecticut income tax withheld from nonpayroll amounts 1st quarter 2nd quarter 3rd quarter 4th quarter 00. Information returns, including recent updates, related forms and instructions on how to file. If the due date falls on a saturday, sunday,. See informational publication 2016(8), connecticut tax guide for payers of nonpayroll. Ad download or email irs 1096 & more fillable forms, register and subscribe now!

Printable Form 1096 Form 1096 (officially the annual summary and

Web 2023 connecticut withholding tax payment form for nonpayroll amounts: It should not be submitted to the state even if you have. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. Open it using the online editor and begin.

Printable Form 1096 / Form 1096 Annual Summary And Transmittal Of U.s

Information returns, including recent updates, related forms and instructions on how to file. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. If the due date falls on a saturday, sunday,. If the due date falls on a saturday,.

Form Ct1096 Athen Connecticut Annual Summary And Transmittal Of

Ad get the latest 1096 form online. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. Special rules apply to designated withholding agents. If the due date falls on a saturday, sunday,. If the due date falls on a.

Form Ct1096 (Drs) Connecticut Annual Summary And Transmittal Of

If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if. Web each group with a separate form 1096. Ad download or email irs 1096 & more fillable forms, register and subscribe now! Special rules apply to designated withholding agents. See electronic filing requirement, below. Your name.

1096 Laser Transmittal IRS Approved 1096 Tax Form Formstax

See electronic filing requirement, below. See informational publication 2016(8), connecticut tax guide for payers of nonpayroll. 01/09) complete for each period connecticut income tax withheld from nonpayroll amounts 1st quarter 2nd quarter 3rd quarter 4th quarter 00. Web each group with a separate form 1096. If the due date falls on a saturday, sunday, or.

Download Form Ct1096 for Free TidyTemplates

You need not submit original and corrected returns separately. Web 2023 connecticut withholding tax payment form for nonpayroll amounts: Ad download or email irs 1096 & more fillable forms, register and subscribe now! Web any person or entity who files any form checked in box 6 above must file form 1096 to transmit those forms.

Form Ct1096 (Drs) Connecticut Annual Summary And Transmittal Of

If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. See informational publication 2016(8), connecticut tax guide for payers of nonpayroll. Information returns, including recent updates, related forms and instructions on how to file. Web 2023 connecticut withholding tax payment.

Printable Form 1096 / 11 Printable form 1096 fillable Templates

Information returns, including recent updates, related forms and instructions on how to file. Web information about form 1096, annual summary and transmittal of u.s. 01/09) complete for each period connecticut income tax withheld from nonpayroll amounts 1st quarter 2nd quarter 3rd quarter 4th quarter 00. Web connecticut annual summary and transmittal of information returns. Special.

Ct 1096 Form Fill Out and Sign Printable PDF Template signNow

Web any person or entity who files any form checked in box 6 above must file form 1096 to transmit those forms to the irs. See informational publication 2017(8), connecticut tax guide for payers of nonpayroll. See electronic filing requirement, below. Information returns, including recent updates, related forms and instructions on how to file. It.

Form Ct1096 Connecticut Annual Summary And Transmittal Of

Fill, edit, download & print. Special rules apply to designated withholding agents. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next. See informational publication 2016(8), connecticut tax guide for payers of nonpayroll. See informational publication 2017(8), connecticut tax guide for payers.

Form Ct 1096 Ad download or email irs 1096 & more fillable forms, register and subscribe now! Fill, edit, download & print. You need not submit original and corrected returns separately. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. Do not send a form (1099, 5498, etc.).

If The Due Date Falls On A Saturday, Sunday, Or Legal Holiday, The Return Will Be Considered Timely If Filed By The Next.

Special rules apply to designated withholding agents. See informational publication 2017(8), connecticut tax guide for payers of nonpayroll. 11/19) department of revenue services state of connecticut po box 2930 hartford ct. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if.

Web Information About Form 1096, Annual Summary And Transmittal Of U.s.

Open it using the online editor and begin altering. Web any person or entity who files any form checked in box 6 above must file form 1096 to transmit those forms to the irs. Information returns, including recent updates, related forms and instructions on how to file. 01/09) complete for each period connecticut income tax withheld from nonpayroll amounts 1st quarter 2nd quarter 3rd quarter 4th quarter 00.

If The Due Date Falls On A Saturday, Sunday,.

Fill, edit, download & print. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. Web 2023 connecticut withholding tax payment form for nonpayroll amounts: Do not send a form (1099, 5498, etc.).

If The Due Date Falls On A Saturday, Sunday,.

You need not submit original and corrected returns separately. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. If the due date falls on a saturday, sunday, or legal holiday, the return will be considered timely if filed by the next business day. Concerned parties names, addresses and numbers etc.